A note before we begin: All scientific numbers here are estimates based on assessments available as of early 2025. They rely on complex climate modelling and come with uncertainty ranges.

Carbon accounting provides organisations with a systematic framework to measure, track, and report their greenhouse gas emissions. This helps both the organisation and external stakeholders understand environmental impact, set reduction targets, track progress, and make informed decisions about where to focus climate efforts.1

Carbon accounting isn’t just an academic exercise—it’s become essential for several interconnected reasons:2

- First, it addresses social responsibility concerns and meets legal requirements that are rapidly expanding worldwide. Many governments now require various forms of emissions reporting, and there’s evidence that programs requiring greenhouse gas accounting actually help lower emissions.

- Second, carbon accounting enables investors to better understand the climate risks of companies they invest in. As climate change increasingly affects business operations—from supply chain disruptions to regulatory changes—understanding a company’s carbon footprint becomes crucial for financial due diligence.

- Third, it supports the net zero emission goals that corporations, cities, and entire nations are adopting. Without accurate measurement, there’s no way to know if reduction efforts are working or where improvements are most needed.

Carbon Budgets

A carbon budget represents the maximum amount of carbon dioxide that humanity can emit while still limiting global warming to a specific temperature threshold, such as 1.5°C or 2°C above pre-industrial levels.3

Carbon budget calculations rely on a scientific concept called Transient Climate Response to Cumulative Emissions (TCRE)—the relationship between cumulative of CO₂ emissions and the resulting temperature increase. Scientists have discovered that global temperature rise is roughly proportional to cumulative carbon emissions. This near-linear relationship is what makes the carbon budget concept possible.45

The IPCC assesses TCRE as likely falling between 0.8 and 2.5°C per 1,000 petagrams of carbon (roughly 0.0004 to 0.0007°C per gigatonne of CO₂). This means that for every 1,000 billion tonnes of CO₂ we emit, we can expect the planet to warm by somewhere in that range.5

To calculate a carbon budget for a specific temperature target, scientists work backward: they determine how much cumulative warming can occur (the temperature target minus warming that has already happened), then divide by the TCRE to get the remaining emissions allowance.56 However, this calculation must also account for non-CO₂ greenhouse gases like methane and nitrous oxide, which complicate the picture. This is done by equating the atmospheric warming provided by non-CO₂ greenhouse gases to that done by CO₂. This and other related concepts are explained in greater detail here.

As of early 2025, the remaining carbon budget to limit warming to 1.5°C with a 50% probability is approximately 130 billion tonnes of CO₂. At current emission rates of roughly 42 gigatonnes of CO₂ per year, this budget will be exhausted in just over three years.78 For context, that’s faster than most infrastructure projects take to complete.

For a slightly higher temperature limit of 1.7°C, the remaining budget is about 525 gigatonnes (roughly 12 years at current rates), and for 2°C, it’s approximately 1,055 gigatonnes (about 25 years at current emission levels).9

Carbon budgets translate into concrete timelines and targets. The roadmaps for achieving these targets are called emissions pathways, which are scenarios showing how greenhouse gas emissions might evolve over time, from today to some point in the future (typically 2030, 2050, or 2100).1011 These pathways are not predictions.12 Rather, they are scenarios showing what could happen under different assumptions, such as policy choices, technological change, behavioural shifts, and socio-economic developments. Our current business-as-usual pathway leads to approximately 2.6°C by 2100 of warming.10 To stay within the 1.5°C budget, global CO₂ emissions would need to reach net zero by around 2050.13 This requires cutting emissions by roughly 50% by 2030 compared to 2019 levels.14 These benchmarks form the basis for actual climate action in the form of national climate commitments (Nationally Determined Contributions or NDCs), corporate emissions reduction targets, and sector-specific goals like phasing out coal or transitioning to electric vehicles.

Scope 1, 2, and 3151617

Since we wish to reduce emissions, once we know which gases to count, the next step is to find out who is responsible for the emissions (since emissions happen at every stage of production and consumption). To understand this, scientists have organised them into three types of emissions based on where they occur in the supply chain of a product that is produced and then consumed.

In short:

- Scope 1: What you emit with your own engines and factories

- Scope 2: What you cause others to emit by buying power/ electricity from them

- Scope 3: What happens because your product exists. This is typically the largest segment of emissions because the same physical emissions are intentionally counted from different points in the value chain—it’s a deliberate feature that allocates responsibility across the value chain rather than assigning blame to a single actor, because Scope 3 captures emissions in proportion with demand.

Now here are the detailed explanations:

Scope 1 covers direct greenhouse gas emissions from sources that an organization owns or controls. These are emissions you create directly through your operations. Examples include:

- Combustion in owned or controlled boilers, furnaces, and vehicles (like company cars or delivery trucks)

- Emissions from chemical production in owned or controlled process equipment

- Fugitive emissions from leaks in equipment or infrastructure (such as refrigerant leaking from air conditioning systems)

Scope 2 includes indirect emissions from the generation of purchased energy—specifically electricity, steam, heating, and cooling consumed by the organization. While you don’t directly create these emissions, you’re indirectly responsible because you’re using the energy that required burning fossil fuels somewhere else.

For example, when you turn on the lights in your office, a power plant might burn coal to generate that electricity. The emissions from the power plant are your Scope 2 emissions. This careful definition of Scope 2 ensures that the power plant reports those emissions as their Scope 1, while you report them as your Scope 2, which avoids double counting at the organisational level.

Scope 3 emissions are the most complex- both to count and to counter. Scope 3 includes all other indirect emissions that occur in an organization’s value chain- both upstream (before your operations) and downstream (after your operations). For most organisations, Scope 3 represents the largest portion of their carbon footprint, often accounting for more than 85% of total emissions.

The Greenhouse Gas Protocol breaks Scope 3 into 15 distinct categories to provide structure and avoid double counting. These categories are divided into upstream and downstream activities:

Upstream Scope 3 Categories (occurring before your operations):1819

- Purchased Goods and Services: Emissions from producing everything you buy—from raw materials to office supplies

- Capital Goods: Emissions from manufacturing physical assets like buildings, machinery, and equipment

- Fuel and Energy-Related Activities: Energy-related emissions not included in Scope 1 or 2, such as transmission losses or extraction of fuels

- Upstream Transportation and Distribution: Emissions from transporting purchased products to you

- Waste Generated in Operations: Emissions from treating and disposing of waste from your operations

- Business Travel: Emissions from employee travel in vehicles not owned by the company

- Employee Commuting: Emissions from employees traveling between home and work

- Upstream Leased Assets: Emissions from operating assets you lease (like leased vehicles or buildings)

Downstream Scope 3 Categories (occurring after your operations):1819

- Investments: Emissions associated with investments, loans, and financial services (particularly relevant for financial institutions)

- Downstream Transportation and Distribution: Emissions from transporting and distributing sold products

- Processing of Sold Products: Emissions from further processing of your intermediate products by others

- Use of Sold Products: Emissions created when customers use your products (huge for industries like automobiles or appliances)

- End-of-Life Treatment of Sold Products: Emissions from disposing of your products after customers are done with them

- Downstream Leased Assets: Emissions from assets you own but lease to others

- Franchises: Emissions from franchise operations (for franchisors)

The Scope 3 Problem

Why do we Count Scope 3 at all? Why not just Scope 1 and 2? The answer is simple: if only Scope 1 and 2 are counted, only a fraction of the true climate impact is being measured. For most organisations, the majority of their greenhouse gas emissions and cost reduction opportunities occur outside their direct operations, because On average across companies, Scope 3 emissions are approximately 26 times larger than Scope 1 and 2 emissions combined:20 no single company can really tell us the magnitude of consumption it supports if only S1 and S2 are counted. For many industries, the disproportion is even more extreme:

- High Tech industry: Scope 3 emissions are 24 times greater than Scope 1 emissions and 13 times greater than Scope 2 emissions.21

- Manufacturing: A manufacturing company analyzed their emissions and found steel procurement alone generated 125,000 metric tonnes of CO₂e annually, with transportation of sold products adding another 45,000 tonnes—these are all Scope 3.22

Think of a product you wish to purchase. It can be anything- a garment, a mobile phone, a table, or a service. If you decide to not buy it, does that product cease to exist? No. But if multiple people decide to not buy that product, the demand for it drops and over time it will not be produced any longer. This is why Scope 3 is attributed to the product being produced.

Other than measuring consumption, counting Scope 3 also serves critical business and accountability purposes:2324

- Identifying Hotspots: You can’t reduce emissions in areas you haven’t measured. Scope 3 analysis reveals where the biggest opportunities lie—perhaps discovering that your transportation partner uses older, inefficient vehicles, or your primary supplier has no renewable energy strategy. Without this visibility, you’re flying blind.

- Supplier Performance Differentiation: Scope 3 measurement lets you distinguish between suppliers who are climate leaders and those who are laggards in sustainability performance. This enables procurement decisions that reward sustainable practice and drive supply chain transformation.

- Regulatory Compliance: Regulations like the EU’s Corporate Sustainability Reporting Directive (CSRD) now mandate Scope 3 disclosure. Ignoring Scope 3 isn’t optional anymore—it’s legally required in many jurisdictions, with non-compliance risking fines and reputational damage.

- Risk Mitigation: Supply chain disruptions, supplier insolvency, and climate-related impacts to suppliers threaten your business. Understanding Scope 3 helps identify and manage these risks.

- Greenwashing Prevention: Companies that claim carbon neutrality while ignoring Scope 3 are engaged in greenwashing—making false environmental claims. Since Scope 3 often represents the majority of footprint, offsetting only Scopes 1 and 2 while ignoring the bulk of emissions is simply “addressing a fraction of actual environmental impact” while pretending to be carbon neutral.

Science-Based Targets Initiative (SBTi) now requires that any company whose Scope 3 emissions represent 40% or more of their total footprint (which is the vast majority of companies) must include Scope 3 in their net-zero commitments. Without this requirement, companies could take credit for reduction efforts that don’t touch the bulk of their emissions—fundamentally undermining climate goals.25

There are distinct and well made arguments against tallying Scope 3 emissions:

- My personal objection is that Scope 3 needs to be restructured to better reflect consumer demand, rather than being presented in a nebulous way that makes it appear primarily as a production issue. Currently, individual customer emissions are only counted as Scope 3, Category 11 (“Use of Sold Products”) in any organisation’s inventory. They are not counted in Scope 1 or Scope 2 anywhere because S1, S2, and S3 emissions are designed to be calculated only for organisations, and not for individuals. This means that all user emissions will still not be captured in S1 and S2 measurement. However, the majority of global emissions are ultimately driven by individual consumption, not pure B2B organisational activity. Instead of counting and recounting emissions as S3, a metric focused on industry-level emissions output would be less confusing, require fewer justifications, and more clearly reveal who is producing and who is consuming what, making it easier to identify where we must make reductions.

- Another reason Scope 3 numbers are so large is because they include lifetime emissions from products (like all the fuel a car will burn over its 15-year life), while Scope 1 and 2 are counted only for a single year. This mixing of annual and lifetime emissions inflates Scope 3 numbers.26

Let’s look at an example:

Imagine a company makes refrigerators and washing machines. What emissions are created when it buys steel, transports parts, and when customers actually use those fridges? The table below shows how far beyond direct emissions the real impact goes:

| SCOPE | CATEGORY | EMISSION SOURCE | SPECIFIC EXAMPLES |

|---|---|---|---|

| SCOPE 1 | Direct Emissions | Company-owned vehicle fleet | – Delivery trucks burning diesel to transport finished appliances to retailers – Forklifts in factory warehouse using propane |

| On-site fuel combustion | – Natural gas burned in factory heating systems – Backup diesel generators at manufacturing facility | ||

| Refrigerant leaks | – Fugitive emissions from refrigerants leaking during manufacturing and testing of refrigerators – HFC leaks from factory air conditioning | ||

| SCOPE 2 | Indirect Energy Emissions | Purchased electricity | – Electricity to power assembly line machinery and robotic equipment – Factory lighting and HVAC systems – Office building computers, servers, and air conditioning |

| Purchased heating/cooling | – District heating purchased for office complex – Chilled water purchased for manufacturing cooling processes | ||

| SCOPE 3 UPSTREAM | Category 1: Purchased Goods & Services | Raw materials and components | – Steel for refrigerator cabinets and washing machine drums – Plastic for control panels and interior components – Electronic circuit boards and control systems – Insulation foam for refrigerators – Motors and compressors purchased from suppliers – Packaging materials (cardboard, foam, plastic wrap) |

| Services | – Legal, accounting, and consulting services – Marketing and advertising agencies – Cleaning and facilities management – IT software and cloud services | ||

| Category 2: Capital Goods | Manufacturing equipment | – Production machinery (stamping presses, welding robots) – Factory buildings and warehouses – Office furniture and equipment | |

| Category 3: Fuel & Energy Related Activities (not in Scope 1 or 2) | Upstream energy emissions | – Extraction and refining of fuels the company purchases – Transmission and distribution (T&D) losses from electricity grid – Production of purchased electricity (upstream of generation) | |

| Category 4: Upstream Transportation & Distribution | Inbound logistics | – Third-party trucks transporting steel from supplier to factory – Ships bringing electronic components from overseas – Warehousing of components before manufacturing | |

| Category 5: Waste Generated in Operations | Manufacturing waste | – Disposal of scrap metal and plastic from manufacturing – Packaging waste from incoming components – Hazardous waste (solvents, oils) disposal | |

| Category 6: Business Travel | Employee travel | – Flights for sales team and executives – Hotel stays during business trips – Rental cars at destination | |

| Category 7: Employee Commuting | Daily commutes | – Employees driving personal cars to factory and offices – Public transit use by employees – Remote work avoided commutes (negative emissions) | |

| Category 8: Upstream Leased Assets | Leased facilities/equipment | – Emissions from operating leased warehouse space – Leased delivery vehicles (if applicable) | |

| SCOPE 3 DOWNSTREAM | Category 9: Downstream Transportation & Distribution | Outbound logistics | – Third-party trucks transporting finished appliances from factory to retail stores – Storage in third-party distribution centers – “Last mile” delivery to customer homes |

| Category 10: Processing of Sold Products | Further processing | – (Not applicable for finished consumer appliances – only relevant if selling intermediate products) | |

| Category 11: Use of Sold Products | REFRIGERATORS: Lifetime electricity consumption | – Refrigerator runs 24/7 for 12-15 year lifespan – Estimated 500 kWh/year consumption2728 × 12 years × 50,000 units sold = 300 million kWh – At 0.5 kg CO₂/kWh = 150,000 tonnes CO₂e Also includes: Refrigerant leakage during use phase (slow release of HFCs over product lifetime) | |

| WASHING MACHINES: Lifetime electricity consumption | – Washing machine used ~250 cycles/year for 10-12 year lifespan – Estimated 1.3 kWh per cycle (assuming warm water)2930 × 250 cycles/year3132 × 11 years × 50,000 units = 179 million kWh – At 0.5 kg CO₂/kWh = 89,500 tonnes CO₂e Also includes (optional): Hot water heating if machine uses hot water | ||

| Customer type doesn’t matter: Emissions counted identically whether customer is: – Individual consumer using refrigerator at home – Hotel using 50 refrigerators in rooms – Laundromat using 20 commercial washing machines | |||

| Category 12: End-of-Life Treatment of Sold Products | Disposal of products | – Landfilling of plastic components (produces methane) – Incineration of products (combustion emissions) – Energy recovery from incineration (avoided emissions) | |

| Recycling processes | – Energy used in dismantling and recycling steel, plastic, electronics – Metal smelting and reprocessing – Note: Recycling typically reduces emissions vs. landfill/incineration | ||

| Refrigerant recovery/disposal | – Emissions from recovering and destroying refrigerants at disposal – Accidental releases if refrigerants not properly recovered | ||

| Customer type doesn’t matter: Same disposal emissions whether disposed by: – Individual homeowner – Commercial hotel replacing room refrigerators | |||

| Category 13: Downstream Leased Assets | Leased-out assets | – If company owns showrooms or warehouses leased to retailers (emissions from their operations) | |

| Category 14: Franchises | Franchise operations | – Not applicable (only relevant if company operates franchise business model) | |

| Category 15: Investments | Investment portfolio | – Emissions from companies the manufacturer has invested in – Relevant mainly for financial institutions |

So the same physical emissions appear multiple times across different inventories—and that’s intentional.33 However, for products with essentially nil Category 11 and 12 emissions, the GHG protocol explicitly states that there is no requirement to consider them, and says that “Companies should account for and report on the Scope 3 categories that are relevant to their business.” A scope 3 category is relevant if it contributes significantly to the company’s total anticipated scope 3 emissions.”34 While materiality thresholds are industry- specific, these are typically used:34

- Focus should be on categories representing ≥80% of estimated Scope 3;

- Categories contributing <1% of total Scope 3 can often be excluded as immaterial

- Categories contributing <5% of total footprint may be deprioritized

National Pathways

The global carbon budget gets divided among countries through their Nationally Determined Contributions (NDCs), which is each country’s climate pledge under the Paris Agreement. Countries outline their post-2020 climate actions, setting targets for emission reductions aligned with their circumstances and capabilities.35

Every five years, countries must submit new NDCs reflecting progressively higher ambition. The Paris Agreement includes transparency provisions requiring countries to track and report progress toward their NDCs through Biennial Transparency Reports and national greenhouse gas inventories.3637

These national commitments translate into sector-specific pathways showing how different parts of the economy—energy, transportation, industry, buildings, agriculture—must evolve to meet overall targets.38 For example, India’s 2030 targets include achieving 500 GW of renewable energy capacity and meeting 50% of energy requirements from renewables.39

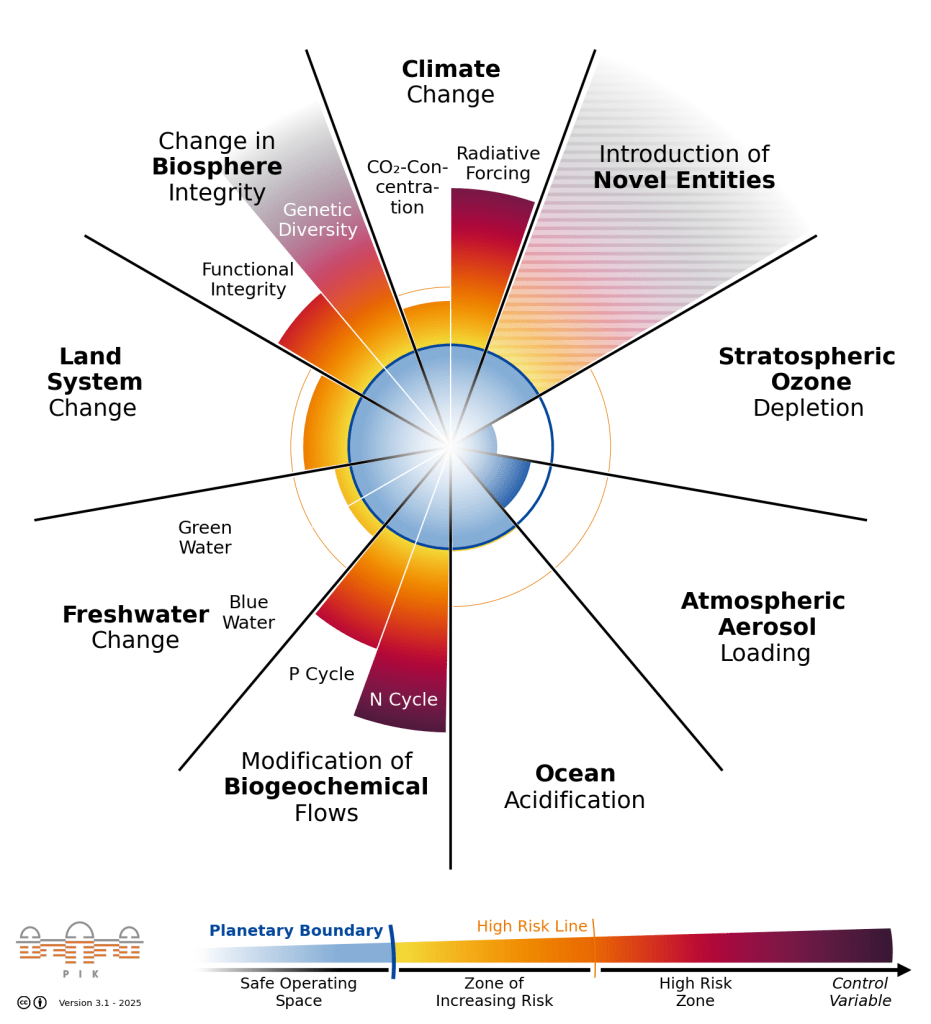

Unfortunately, current national commitments fall well short of what’s needed to stay within safe temperature limits. Even if all countries fully implemented their NDCs, we would still far exceed the 1.5°C carbon budget and likely breach the 2°C threshold as well. This shortfall—called the “emissions gap”—represents the difference between where current policies will take us and where we need to be.8

To stay within the 1.5°C budget, global CO₂ emissions must reach net zero (where removals equal emissions) by around 2050.13 For all greenhouse gases (including methane and others), net zero must occur in the second half of the century.40 Reaching net zero requires dramatic transformations: phasing out unabated fossil fuel consumption, scaling up renewable energy, electrifying transportation and industry, halting deforestation, and deploying carbon removal technologies.41 The pace of change needed is extraordinary—cutting emissions by nearly 6 gigatonnes per year (6 gigatonnes = 6 billion tonnes = 6,000,000,000 tonnes of CO₂: Average car emissions: ~4.6 tonnes CO₂/year of a typical petrol car driven ~20,000 km/year,42 6 gigatonnes = 1.3 billion cars’ worth of annual emissions, OR one homemade cake baked in an oven: ~0.5 kg CO₂,43 so 6 gigatonnes = 12 trillion cakes, which is 1,500 cakes per person on Earth) starting immediately.8

In conclusion, unlike many pollutants that eventually break down or wash out of the atmosphere, CO₂ persists for centuries to millennia. This means that climate change is determined not by our annual emission rate, but by the cumulative sum of all emissions over time.44 Whether we emit a tonne today or ten years from now matters less than the total cumulative amount we emit.44

This cumulative relationship is what makes carbon budgets meaningful.45 Each year of current emissions consumes our remaining budget, bringing us closer to temperature thresholds.9 The remaining budget for 1.5°C shrinks annually, and at current emission rates of about 42 gigatonnes per year, it dwindles rapidly.9

So here’s the Scope 3 Problem: most emissions are driven by what we collectively choose to produce and consume, not just how efficiently we run factories or power offices. Improving Scope 1 and 2 emissions is essential and non-negotiable. But even a fully electrified, renewable-powered industrial system will still emit too much if it continues to produce ever-growing volumes of energy- and material-intensive goods. This is ultimately why Scope 3 emissions matter so much, despite their accounting complexity. A product’s emissions are not inevitable facts of nature: they are contingent on demand. Understanding Scope 3 emissions exposes collective consumption—not just operational efficiency—as the core challenge driving climate change.

Sources

- Carbon Accounting Explained | CarbonChain

- Carbon Accounting Guide for Business 2025 | Ecoskills Academy

- The Global Carbon Budget FAQs 2025 | Global Carbon Budget

- Assessing the size and uncertainty of remaining carbon budgets | Nature Climate Change

- Differences between carbon budget estimates unravelled | IIASA

- The Remaining Carbon Budget: A Review | Frontiers in Climate

- Current Remaining Carbon Budget and Trajectory Till Exhaustion | Climate Change Tracker

- 1.5 Degrees C Target Explained | WRI

- Fossil-fuel CO2 emissions to set new record in 2025 as land sink recovers | Carbon Brief

- Emissions pathways to 2100 | Climate Action Tracker

- Chapter 3: Mitigation pathways compatible with long-term goals | IPCC AR6 WGIII

- IPCC AR6 WGIII Annex III | IPCC

- Special Report on Global Warming of 1.5°C | IPCC

- IPCC AR6 WGIII Summary for Policymakers | IPCC

- Explaining Scope 1, 2 & 3 | India GHG Program

- Scope 1, 2 & 3 Emissions Explained | CarbonNeutral

- Scope 1, 2 & 3 Emissions | CarbonChain

- Exploring the 15 Categories of Scope 3 Emissions | LinkedIn

- Upstream vs. Downstream Emissions | Persefoni

- Supply chain Scope 3 emissions are 26 times higher than operational emissions | CDP

- Can You See Your Scope 3? | Accenture

- Scope 3 Carbon Emissions Examples Unveiled | Ecohedge

- What are Scope 3 emissions and why do they matter? | Carbon Trust

- Scope 3 Emissions Examples in Supply Chains | Ecohedge

- Scope 3: Stepping up science-based action | Science Based Targets

- Myth-busting: Are corporate Scope 3 emissions far greater than Scopes 1 or 2? | GHG Institute

- Electricity Use in Homes | U.S. EIA

- Bureau of Energy Efficiency India | BEE

- Clothes Washers | ENERGY STAR

- Product Environmental Footprint | European Commission

- Clothes Washers | U.S. Department of Energy

- EU Regulation 1015/2010 – Washing Machines | EUR-Lex

- Scope 3 Frequently Asked Questions | GHG Protocol

- Corporate Value Chain (Scope 3) Accounting and Reporting Standard | GHG Protocol

- Nationally Determined Contributions (NDCs) | UNFCCC

- MRV Systems: Reporting | CCAFS

- Central Asia Guidance Document of NDC Reporting | Climate Action Transparency

- Tracking progress towards NDCs | OECD

- Net Zero Emissions Target | Press Information Bureau, Government of India

- Chapter 2 | IPCC SR15

- Net Zero by 2050 | IEA

- Greenhouse Gas Emissions from a Typical Passenger Vehicle | U.S. EPA

- How carbon-heavy is my favourite cake? | Decarbonate

- Chapter 5: Global Carbon and Other Biogeochemical Cycles and Feedbacks | IPCC AR6 WGI

- Summary for Policymakers | IPCC AR6 WGI